by Amy Iannone

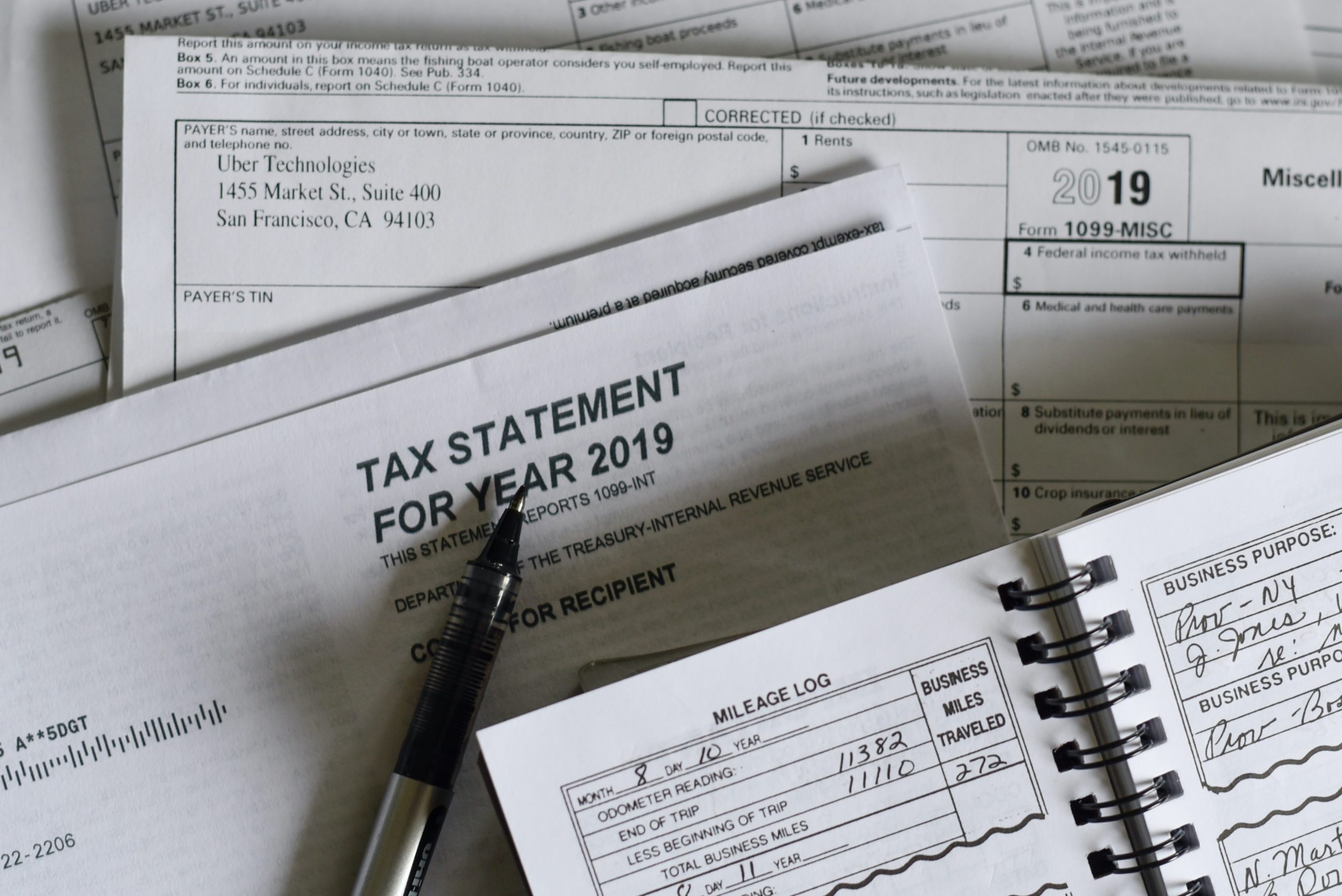

From day one of your business, it’s recommended that you create a bookkeeping system, gather receipts, and keep track of sales and expenses.

This can be as simple as writing transactions in a notebook/ledger book, on index cards, keeping receipts in file folders, keeping a spreadsheet, or using bookkeeping or tax software.

There will come a time when you will need to focus more on your business and your clients, and you will need to consider hiring a professional. Think about some of the other things you could you be doing in the time that it takes you to do your own bookkeeping and income taxes.

Ask yourself:

- Could you be better serving your clients?

- Could you be generating new clients or making more sales?

- Could you be spending more time with your family? Taking a day off? Going on vacation?

Determine the following:

- Am I doing my bookkeeping and taxes correctly?

- What will it cost me later if I am not?

Having a professional maintain your bookkeeping and prepare and file your tax returns will give you peace of mind and provide you with a trusted advisor to ask questions and proactively help your business.

Should I hire an employee or a contractor?

You can choose to hire an employee or an independent contractor. Hiring an employee is more complicated and may not fit with your initial budget due to additional taxes and insurance. You will also have to train an employee on what to do/oversee their work.

However, hiring an independent contractor or a firm will allow you to only pay for the services that you need. You can avoid having to deal with payroll taxes, and you will get a professional who will have the expert knowledge to not only do the work, but to advise you on bookkeeping and tax related questions.

Where do I find a bookkeeper?

- Ask other business owners for referrals for who they use

- Ask in networking groups in your area or industry

- Google “bookkeeper near me”

- Search for a QuickBooks Online Find a ProAdvisor Directory: https://quickbooks.intuit.com/find-an-accountant/

- Search for a Xero Bookkeeper Advisor: https://advisorconnect.xero.com/search-for-advisors

- Search for a Digital Bookkeeper Association bookkeeper: https://dba.org/directory/

What about income taxes?

You should hire a professional tax preparer for the same reasons that you would want to hire a bookkeeper.

Note that this may or may not be the same person or firm that does your bookkeeping, and does not have to be a Certified Public Accountant (CPA) unless your business is publicly traded, a government agency, or is in an industry that is regulated such as healthcare or education.

Note that there are different levels of tax preparers and what representation rights that they have. You can find more information here: https://www.irs.gov/tax-professionals/understanding-tax-return-preparer-credentials-and-qualifications

Where do I find a tax preparer?

- Ask other business owners for referrals for who they use

- Ask in networking groups in your area or industry

- Google “tax preparer near me”

- Search the IRS Directory by ZIP code or by their name to verify them: https://irs.treasury.gov/rpo/rpo.jsf

- Search this directory: https://taxpreparers.com/

How do I screen a bookkeeper or a tax preparer?

Ideally, you want to find someone who understands your industry and business. Book a consultation and ask them about their experience and certifications. They should ask you open-ended questions about your bookkeeping, income taxes, challenges your business faces, how your customers pay you, how you pay your vendors, your payroll details, and how you are managing your receipts.

Find out what their process is for working with clients with regards to connecting to accounts, uploading and downloading documentation, and if they have an office or are completely online and virtual. Check out their reviews on different platforms, but do not ask them for references, as they are under a confidentiality clause with all of their clients and will not be able to give out any details.

Ask them about what services they offer, how and how often meetings are held, and if they prepare financial statements or other reports. Can they advise you with budgeting, benchmarking and cost analyses, and are they are an authorized IRS e-file provider?

Be sure to ask if they charge an hourly or a flat rate, and read their Engagement Letter Agreement very carefully for what their Scope of Work entails. Ask if they charge upfront or invoice after work is completed!

Don’t wait until April 15 or October 15 to begin your search for a bookkeeping and tax professional! Be respectful of the many hours that it took them to learn their craft and be able to keep up with the numerous and ever changing tax laws. Someone who is a good fit will help your business grow and thrive, and will be an integral part of your team.

Amy Iannone is a Bookkeeping & Tax Professional who founded Professional Bookkeeping & Tax Assistants in 2017 to help small business owners get financially organized, realize their profit, manage their payroll and stay current on their taxes.

Explore her socials for Professional Bookkeeping & Tax Assistants services!

Want more from Outgrow Your Garage?

-Support, connections and resources are invaluable tools for entrepreneurs. Small business owners from a variety of industries come together twice a week for Co-Working & Office Hours to work on their businesses, share insights, and troubleshoot issues. Running a business can feel isolating. You don’t have to do it alone!

-Business education should be easily accessible for everyone at an affordable price. We want you and your small business to succeed. No matter what area of your business you need help in, we offer a variety of business course topics that teach you how to turn your every day tasks into organized systems.

Leave a Reply